Energy network companies will be allowed to charge households more than initially planned over the next five years after the regulator gave ground in a battle over their spending and profits.

Shares in National Grid and SSE both rose on the Ofgem announcement, although SSE said that it was still “very disappointed” and the companies kept open the option of appealing to the competition watchdog for a more generous deal.

Network companies’ spending on Britain’s pipes and wires is funded through levies on energy bills that are determined by Ofgem in multi-year “price control” settlements.

Ofgem said that a typical household should still see a £10 real-terms reduction in the amount they pay on their energy bills to fund Britain’s gas pipeline and electricity transmission cabling networks from next year. However, that is less than an original saving of £20 under draft plans issued in July.

The regulator said that it had now given upfront approval for £30 billion of investment from 2021 to 2026, up from £25 billion in the draft settlement, after companies provided more evidence to justify their plans. A further £10 billion or more of investment in green projects to support Britain’s net zero goal could be approved during the next five years.

Ofgem also said that companies should be allowed to deliver higher returns to investors, with a proposed return on equity of 4.3 per cent, up from 3.95 per cent proposed in the summer.

However, that is still almost 40 per cent lower than under the current price control and is still “the lowest ever cost of capital rate for energy network companies”.

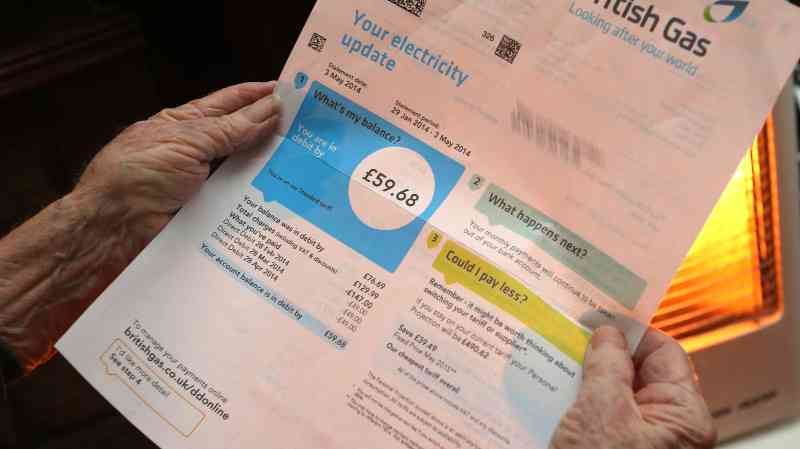

Levies to fund energy networks make up about £250 on a typical annual household energy bill. Of this, about £159 at present goes to fund the gas networks, electricity transmission networks and the electricity system operator. Ofgem said that this should fall to £149 from next year, excluding inflation, before rising during the next five years to be around similar levels to today in real terms by 2026. The rest of the network charges on a typical bill are for electricity distribution networks which are subject to a separate price control settlement starting in 2023.

Ofgem and the network companies have been at loggerheads since July when the regulator said that it would disallow £8 billion of their proposed spending plans. National Grid, which saw the biggest cuts, had claimed the proposals put Britain at risk of blackouts.

The regulator has now relented on £4 billion of these cuts, and also allowed a further £1 billion of other spending. It said that it had received “much better evidence”, including about 20,000 pages of additional documents from companies to justify their proposed investments.

However, a senior source at one network company claimed that the change reflected that Ofgem’s draft price control had been “riddled with errors and mistakes” that had now been rectified.

Network companies are hoping Ofgem will relent further on the returns they can make for investors. A similar system of price controls operates in the water sector and water companies appealed to the Competition and Markets Authority after their regulator, Ofwat, also proposed cutting their returns. In a draft ruling in September, the CMA sided with the water companies and proposed a level of returns that is higher than Ofgem is now proposing for the energy networks.

SSE said that it was “very disappointed that Ofgem has not fully reflected the robust evidence — particularly that from the CMA provisional findings of the PR19 water price control appeal — in setting the financial parameters” for the energy networks.

Jonathan Brearley, Ofgem chief executive, said that the costs of investing in greener networks “must fall fairly for consumers” and that it was “reducing the amount paid to shareholders so that they are closer to current market levels”.

Network companies have until early March to decide whether to appeal to the CMA, which is expected to issue a final decision on the water case in February.

Martin Young, analyst at Investec, said that appeals to the CMA were “a distinct possibility” depending on the final CMA verdict in the water sector. If the CMA set a return for water above that proposed by Ofgem for energy “then Ofgem has a problem, and we would expect that at least one network would appeal to the CMA”, he said.

National Grid shares were up 1.6 per cent by late morning while SSE shares were about 2.4 per cent higher.